Toggle light

Comments

69 Views

Report

Favorite

If current server doesn't work please try other servers below.

Server

2embed

Server

Multi

Server

Vidsrc

Score: 10 / 5 rated

A Comprehensive Guide to Car Insurance Everything You Need to Know

A Comprehensive Guide to Car Insurance: Everything You Need to Know

Car insurance is one of the most essential aspects of responsible car ownership. It offers financial protection in case of accidents, theft, or damage to your vehicle, as well as providing liability coverage for damage caused to others. For those navigating the complexities of car insurance, whether you’re purchasing your first policy or looking to update your coverage, it can be difficult to determine the right type of insurance for your needs.

This comprehensive guide aims to provide all the information you need about car insurance, including its importance, the types of coverage available, how to choose the best policy for your needs, and tips for saving money on premiums. With over 2,000 words of user-friendly information, this article is designed to be both informative and accessible for anyone seeking to learn about car insurance.

What is Car Insurance?

Car insurance is a contract between you and an insurance company that helps protect you financially in the event of an accident or damage to your car. In exchange for paying regular premiums, the insurance company agrees to cover specific types of damage to your vehicle or cover the costs of repairs, medical expenses, and legal fees if you are involved in an accident. Additionally, car insurance can help protect other drivers and passengers if you are at fault for an accident.

Car insurance policies typically include a variety of coverage types, each designed to address specific aspects of driving, such as liability, property damage, and personal injuries. The right car insurance policy ensures that you are financially protected, giving you peace of mind while on the road.

Why is Car Insurance Important?

Car insurance is not only a legal requirement in most places, but it also offers several critical benefits that protect you, your passengers, and other people on the road.

1. Legal Requirement

In many states and countries, car insurance is a legal requirement. If you drive without insurance, you could face fines, license suspension, or even jail time. Even if it’s not mandatory in your location, having car insurance is a responsible decision for anyone who owns or drives a car.

2. Financial Protection

Car accidents can lead to costly repairs, medical bills, and legal expenses. Without car insurance, you would be personally responsible for paying for these expenses, which could lead to significant financial hardship. Car insurance protects you from these unexpected costs by covering the expenses up to the limits of your policy.

3. Protection from Uninsured Drivers

Despite being required by law, many drivers still operate their vehicles without car insurance. If you’re involved in an accident with an uninsured driver, their lack of insurance can make it difficult to receive compensation for damages. However, with the right car insurance, you can ensure that you’re protected from the financial consequences of an accident caused by an uninsured or underinsured driver.

4. Peace of Mind

Knowing that you have comprehensive car insurance coverage provides peace of mind while on the road. Whether you’re dealing with an accident, vehicle damage, or theft, having car insurance helps you navigate these challenges more easily, knowing that you’re financially protected.

5. Protecting Others

Car insurance isn’t just for your own protection—it also helps protect other drivers, passengers, and pedestrians. If you’re at fault for an accident, liability coverage will help pay for medical bills, property damage, and other expenses incurred by the other party involved in the accident.

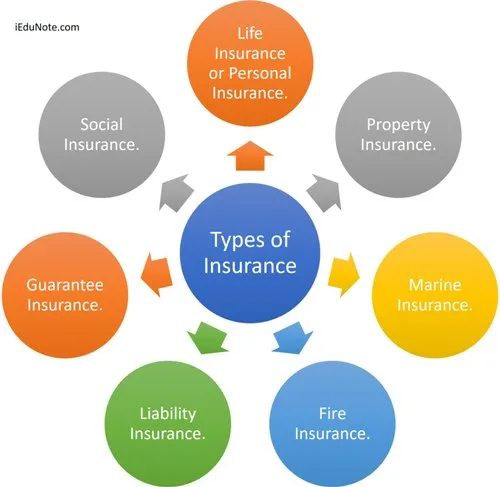

Types of Car Insurance Coverage

Car insurance policies typically offer a combination of different types of coverage. Depending on your needs and budget, you may choose a policy that includes one or more types of coverage. Here are the most common types of car insurance:

1. Liability Insurance

Liability insurance is the most basic type of car insurance and is required in most states. This coverage pays for damage and injuries you cause to others in an accident where you are at fault. Liability insurance is divided into two types:

- Bodily Injury Liability: Covers medical expenses, pain and suffering, and lost wages of other people involved in the accident.

- Property Damage Liability: Covers the cost of repairs or replacement of another person’s property, such as their car, fence, or building, that you damaged in an accident.

Pros:

- Essential for legal protection in case you cause an accident.

- Required by law in most places.

Cons:

- Does not cover your own vehicle or medical expenses.

2. Collision Insurance

Collision coverage pays for repairs to your own vehicle if you are involved in an accident, regardless of who is at fault. If your car is totaled, this coverage will pay for its replacement, minus the deductible.

Pros:

- Covers your own vehicle in case of an accident, even if you’re at fault.

- Provides protection regardless of the other driver’s insurance status.

Cons:

- Typically comes with a deductible.

- Premiums are higher than liability insurance.

3. Comprehensive Insurance

Comprehensive insurance, sometimes called “other than collision” coverage, helps pay for damage to your car that is not caused by a collision. This includes theft, vandalism, natural disasters, fire, and damage from hitting an animal.

Pros:

- Covers a wide range of non-collision-related damages.

- Useful for protecting your vehicle from theft or natural disasters.

Cons:

- Higher premiums.

- Doesn’t cover collision-related damages.

4. Personal Injury Protection (PIP)

Personal Injury Protection (PIP) insurance covers medical expenses for you and your passengers, no matter who is at fault for the accident. It can also help pay for lost wages and other expenses related to your injuries.

Pros:

- Covers medical expenses for you and your passengers.

- Provides coverage regardless of who is at fault in the accident.

Cons:

- Can be expensive, especially in states with high medical costs.

- Not available in all states.

5. Uninsured/Underinsured Motorist Coverage

This type of coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. It can also cover hit-and-run accidents.

Pros:

- Provides protection when the other driver is uninsured or underinsured.

- Offers financial support in hit-and-run scenarios.

Cons:

- Additional premium costs.

- Only available in certain states.

6. Medical Payments Coverage (MedPay)

MedPay is similar to PIP coverage but generally only covers medical expenses for you and your passengers. It does not cover lost wages or other non-medical expenses. This coverage is typically available in no-fault states.

Pros:

- Covers medical bills for you and your passengers.

- Useful if you don’t have health insurance.

Cons:

- Doesn’t cover lost wages or property damage.

- Typically has limited coverage amounts.

7. Gap Insurance

Gap insurance covers the difference between the actual cash value (ACV) of your car and the amount you owe on your auto loan or lease. If your car is totaled or stolen, gap insurance ensures you don’t have to pay out-of-pocket to cover the remaining balance on your loan or lease.

Pros:

- Covers the difference between your car’s value and the loan balance.

- Useful if you owe more on your car than it’s worth.

Cons:

- Only applicable if you have an outstanding loan or lease.

- Doesn’t apply if you own the car outright.

How to Choose the Right Car Insurance Policy

Choosing the right car insurance policy can be a daunting task, especially with the wide range of coverage options available. Here’s how to select the best policy for your needs:

1. Assess Your Needs

Start by evaluating your driving habits, your car’s value, and your financial situation. If you drive a newer car with a high value, it’s worth considering comprehensive and collision coverage. If your car is older and has a low market value, you may not need full coverage and could opt for a policy that only includes liability coverage.

2. Compare Quotes from Multiple Providers

Don’t settle for the first quote you receive. It’s important to compare quotes from different insurance providers to find the best coverage at the most affordable price. Online comparison tools can help you easily compare premiums and coverage options.

3. Consider Deductibles

The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. A higher deductible usually results in lower monthly premiums, but it also means you’ll pay more out of pocket in the event of a claim. Choose a deductible that aligns with your budget and risk tolerance.

4. Look for Discounts

Many car insurance providers offer discounts that can help reduce your premium. Common discounts include safe driver discounts, multi-car discounts, bundling policies (e.g., home and car insurance), and discounts for having safety features in your car (e.g., airbags, anti-theft systems).

5. Check the Insurer’s Reputation

Before choosing an insurance provider, research their reputation for customer service, claims handling, and financial stability. Look for reviews from current and past customers, and check the insurer’s rating with agencies like A.M. Best, Moody’s, or Standard & Poor’s.

How to Save Money on Car Insurance

Car insurance premiums can add up, but there are several ways to lower your costs without compromising coverage:

1. Maintain a Clean Driving Record

Your driving history plays a significant role in determining your insurance premiums. Drivers with a clean record (no accidents, traffic violations, or claims) are typically rewarded with lower rates. Safe driving can also help you qualify for discounts.

2. Drive a Vehicle with Safety Features

Cars equipped with advanced safety features such as airbags, anti-lock brakes, and collision warning systems are often eligible for lower premiums. Insurers view these vehicles as less risky to insure.

3. Bundle Policies

Many insurance companies offer discounts for bundling your car insurance with other policies, such as homeowners or renters insurance. Bundling can often result in significant savings.

4. Choose a Higher Deductible

Opting for a higher deductible can lower your monthly premiums. However, be sure that you can comfortably afford the deductible if you need to file a claim.

5. Pay Premiums in Full

Some insurance providers offer a discount for paying your premium in full upfront rather than on a monthly or quarterly basis. If you’re able to do so, paying in full can help you save money.

Post Views: 6

Genre: Blog

Director:

You may also like

Report Content

A Comprehensive Guide to Car Insurance Everything You Need to Know

Movie