Toggle light

Comments

122 Views

Report

Favorite

If current server doesn't work please try other servers below.

Server

2embed

Server

Multi

Server

Vidsrc

Score: 10 / 5 rated

A Comprehensive Guide to Life Insurance Protecting Your Future

A Comprehensive Guide to Life Insurance: Protecting Your Future

Life insurance is more than just a financial product; it is a vital part of planning for your family’s future. By ensuring financial security and peace of mind, life insurance serves as a safety net for your loved ones in times of uncertainty. Yet, many people remain confused about how life insurance works, what types are available, and how to choose the right policy.

This comprehensive article will guide you through the fundamentals of life insurance, its types, benefits, tips for purchasing the right policy, and how it fits into a broader financial plan. Whether you’re buying life insurance for the first time or reassessing your current policy, this 2,000-word guide is designed to be both user-friendly and informative.

What Is Life Insurance?

Life insurance is a contract between you and an insurance company. In exchange for regular premium payments, the insurer agrees to pay a sum of money, known as a death benefit, to your beneficiaries when you pass away.

Why Is Life Insurance Important?

- Financial Security: Life insurance ensures that your family can cover expenses such as mortgages, education, or daily living costs after your death.

- Debt Protection: It can prevent your loved ones from inheriting unpaid debts.

- Peace of Mind: Knowing your family is financially protected can reduce stress and anxiety about the future.

- Estate Planning: Life insurance can be an integral part of wealth transfer and estate planning strategies.

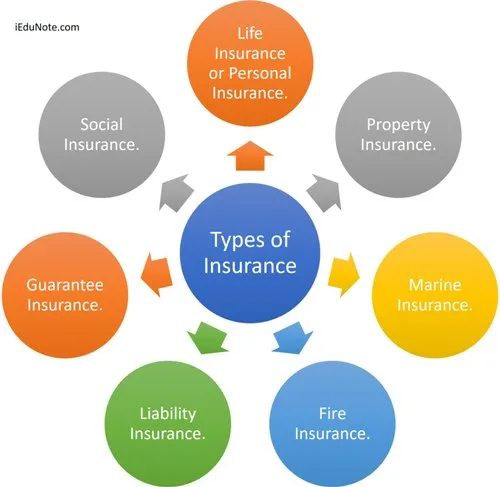

Types of Life Insurance

Life insurance policies fall into two main categories: term life insurance and permanent life insurance. Each has unique features and benefits tailored to different needs.

1. Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years.

- Affordable: Term policies are usually cheaper than permanent ones.

- Simple Coverage: The policy pays a death benefit if you pass away during the term.

- Best For: People seeking temporary coverage, such as during mortgage repayment years or while raising children.

2. Permanent Life Insurance

Permanent life insurance provides lifelong coverage and includes a cash value component that grows over time. There are three primary types:

a. Whole Life Insurance

- Provides a fixed premium and guaranteed death benefit.

- Builds cash value that grows at a guaranteed rate.

- Ideal for those seeking predictable, long-term financial security.

b. Universal Life Insurance (UL)

- Offers flexible premiums and adjustable death benefits.

- The cash value grows based on market-linked interest rates.

- Best for individuals looking for flexibility in their policy.

c. Variable Life Insurance (VLI)

- Allows policyholders to invest the cash value in various investment options, such as stocks or bonds.

- Higher growth potential, but also higher risk.

- Suitable for financially savvy individuals willing to manage investment risks.

How Life Insurance Works

The mechanics of life insurance are straightforward:

- Application: You fill out an application with personal and financial information. This often includes a health assessment.

- Premiums: Once approved, you pay premiums (monthly or annually) to keep the policy active.

- Death Benefit: If you pass away while the policy is in effect, the insurer pays the agreed-upon death benefit to your beneficiaries.

Key Terms to Understand

- Policyholder: The person who owns the insurance policy.

- Beneficiary: The person(s) who receive the death benefit.

- Face Value: The amount of the death benefit specified in the policy.

- Cash Value: A savings component available in permanent life insurance policies.

Do You Need Life Insurance?

The decision to purchase life insurance depends on your personal circumstances. Here are some scenarios where life insurance is essential:

- Parents with Dependents: To ensure your children’s financial future in case of your untimely death.

- Spouses or Partners: To replace lost income for a surviving spouse.

- Homeowners: To cover mortgage payments and prevent foreclosure.

- Business Owners: To secure business continuity through a buy-sell agreement or to pay off business debts.

- Individuals with Debt: To prevent your debts from being passed on to your loved ones.

How to Choose the Right Life Insurance Policy

Finding the perfect policy requires a careful evaluation of your needs, budget, and long-term goals.

1. Assess Your Financial Needs

Start by calculating the financial obligations you want to cover, such as:

- Daily living expenses for your family.

- Outstanding debts (mortgages, car loans, credit cards).

- Future expenses like college tuition.

2. Consider Your Budget

Select a policy you can comfortably afford over the long term. While permanent policies offer added benefits, they come with higher premiums.

3. Compare Policies

Get quotes from multiple insurers and review the terms, conditions, and costs associated with each policy.

4. Choose the Right Coverage Amount

Experts often recommend coverage that’s 10-12 times your annual income. Adjust this based on your unique financial responsibilities.

5. Seek Professional Advice

Consult a licensed insurance agent or financial advisor to help you navigate complex options.

Factors That Affect Life Insurance Premiums

Life insurance premiums are calculated based on several factors, including:

- Age: Younger individuals typically pay lower premiums.

- Health: Medical history, current health conditions, and lifestyle choices affect your rates.

- Gender: Women often pay less than men due to longer life expectancy.

- Policy Type: Permanent policies cost more than term policies.

- Coverage Amount: Higher coverage leads to higher premiums.

- Smoking Status: Smokers pay significantly higher rates due to associated health risks.

Benefits of Life Insurance

Life insurance offers numerous benefits that extend beyond the obvious financial protection:

1. Income Replacement

Ensures your family can maintain their standard of living in your absence.

2. Debt Relief

Prevents loved ones from inheriting unpaid debts, such as mortgages or student loans.

3. Tax-Free Death Benefit

The payout is generally exempt from income tax, maximizing its value to beneficiaries.

4. Cash Value Growth

Permanent policies build cash value, which can be borrowed against or withdrawn during your lifetime.

5. Estate Planning

Provides liquidity for estate taxes or other expenses, ensuring your assets are preserved.

How to Save Money on Life Insurance

Life insurance doesn’t have to break the bank. Here are strategies to reduce costs:

1. Buy Early

Lock in lower premiums by purchasing a policy when you’re young and healthy.

2. Choose Term Life Insurance

Term policies are more affordable and ideal for temporary needs.

3. Compare Rates

Shop around to find the best deal from reputable insurers.

4. Improve Your Health

Adopt a healthy lifestyle to qualify for lower premiums. Quit smoking, exercise regularly, and maintain a balanced diet.

5. Bundle Policies

Some insurers offer discounts if you purchase multiple policies, such as life and auto insurance.

Common Myths About Life Insurance

1. Life Insurance Is Expensive

Many people overestimate the cost of life insurance. Affordable options are available for all budgets.

2. Single People Don’t Need Life Insurance

Even if you’re single, life insurance can cover debts, funeral costs, or provide financial support for aging parents or siblings.

3. Employer Coverage Is Enough

Employer-sponsored policies often provide limited coverage, which may not meet your family’s financial needs.

4. Life Insurance Is Only for Older People

The earlier you buy life insurance, the lower your premiums will be, making it a smart choice for young adults.

How to File a Life Insurance Claim

Filing a claim is a straightforward process:

- Notify the Insurer: Contact the insurance company and provide the policy details.

- Submit Required Documents: This includes the death certificate and claim forms.

- Review and Approval: The insurer will review the claim, which typically takes a few weeks.

- Receive the Payout: Once approved, the death benefit is paid to the beneficiaries.

Why Regularly Reviewing Your Policy Is Important

Life circumstances change over time. Regularly review your policy to ensure it still aligns with your needs. Update beneficiaries, coverage amounts, or policy terms after major life events like marriage, childbirth, or retirement.

What is Life Insurance?

Life insurance is a contract between a policyholder and an insurance company. In exchange for regular premium payments, the insurer agrees to pay a lump sum of money, known as the death benefit, to your beneficiaries upon your death. This money is used by your beneficiaries to cover funeral expenses, outstanding debts, daily living costs, and other financial obligations that might arise in the absence of your income.

Life insurance is not just for those who are nearing the end of their life; it is a financial planning tool that can benefit people of all ages and life stages. From young adults who want to protect their families to business owners needing coverage for their employees, life insurance can meet a variety of needs.

Why Is Life Insurance Important?

While life insurance is not a pleasant topic to think about, it is one of the most important financial decisions you can make for your family. Below are several reasons why life insurance is crucial:

1. Financial Protection for Loved Ones

The most important reason to have life insurance is to provide financial security for your loved ones after your death. If you are the primary breadwinner in your household, life insurance ensures that your family won’t face financial hardship. It can replace lost income and ensure that your family can continue living comfortably.

2. Debt Repayment

Life insurance can be used to pay off debts, including mortgages, car loans, credit card bills, and other personal debts. Without life insurance, your family might be left to shoulder these financial burdens on their own.

3. Funeral and Final Expenses

The cost of funeral services and other final expenses can quickly add up. Life insurance can help cover these expenses, easing the financial burden on your family during an already difficult time.

4. Child’s Education

If you have children, you may want to ensure that their education is taken care of in the event of your death. Life insurance can provide a sufficient amount of coverage to fund your child’s tuition and other educational expenses.

5. Estate Planning

Life insurance can be a valuable tool in estate planning, helping to pay estate taxes, provide liquidity for your estate, and ensure that your assets are passed on according to your wishes.

6. Peace of Mind

Having life insurance gives you peace of mind, knowing that your loved ones will be financially secure, even if you are no longer there to provide for them.

Types of Life Insurance

There are several different types of life insurance policies, each designed to meet specific needs. The two main categories are term life insurance and permanent life insurance.

1. Term Life Insurance

Term life insurance is the simplest and most affordable type of life insurance. It provides coverage for a specific term, such as 10, 20, or 30 years. If you pass away during the term of the policy, your beneficiaries receive the death benefit. If you outlive the policy, there is no payout.

Key Features of Term Life Insurance:

- Affordable premiums: Term life insurance is generally the least expensive type of coverage.

- Fixed coverage period: Coverage is available for a set number of years, usually between 10 and 30 years.

- Death benefit only: There is no cash value component, meaning the policy only provides a death benefit if you pass away within the term.

- Renewable: Some term policies can be renewed or converted to permanent policies at the end of the term.

Best For: People looking for affordable, short-term coverage, such as young families or those with temporary financial obligations like a mortgage or child’s education.

2. Permanent Life Insurance

Permanent life insurance offers lifelong coverage and includes an investment component known as cash value, which grows over time. There are several types of permanent life insurance, including whole life, universal life, and variable life insurance.

a. Whole Life Insurance

Whole life insurance provides coverage for your entire life as long as you continue to pay the premiums. The policy has a fixed premium, a guaranteed death benefit, and a cash value component that grows over time. You can borrow against the cash value or use it to pay premiums.

Key Features of Whole Life Insurance:

- Lifelong coverage: As long as premiums are paid, the policy remains in force.

- Fixed premiums: Premiums are consistent throughout the life of the policy.

- Cash value growth: The policy accumulates cash value, which grows at a guaranteed rate.

- Guaranteed death benefit: Your beneficiaries are assured of a death benefit payout.

Best For: Individuals looking for lifelong coverage and those interested in building cash value for long-term savings or loans.

b. Universal Life Insurance (UL)

Universal life insurance provides more flexibility than whole life insurance. With a UL policy, you can adjust your premiums and death benefits within certain limits. The cash value grows based on interest rates, which may fluctuate over time.

Key Features of Universal Life Insurance:

- Flexible premiums: You can adjust the premium amount and frequency.

- Adjustable death benefit: The death benefit can be increased or decreased based on your needs.

- Cash value growth: The policy’s cash value grows at an interest rate set by the insurer, with a minimum guaranteed rate.

- Loans and withdrawals: You can borrow against the cash value of the policy.

Best For: Those looking for more flexibility in their life insurance policy, as well as those who want to accumulate cash value over time.

c. Variable Life Insurance (VLI)

Variable life insurance combines the features of a universal life policy with investment options. The cash value in a VLI policy can be invested in stocks, bonds, or mutual funds, offering the potential for higher growth. However, these investments carry more risk, and the value of the policy can fluctuate based on the performance of the investments.

Key Features of Variable Life Insurance:

- Investment options: You can choose where to invest the cash value (stocks, bonds, etc.).

- Flexible premiums: You can adjust premiums to fit your financial situation.

- Risk and reward: The cash value and death benefit can increase or decrease depending on the performance of your investments.

Best For: Individuals who are comfortable with taking investment risks and want the potential for higher cash value growth.

How to Choose the Right Life Insurance Policy

Choosing the right life insurance policy depends on your individual needs, financial situation, and long-term goals. Here are some steps to help guide your decision:

1. Assess Your Financial Needs

Start by calculating your family’s financial needs, including:

- Your income and how much of it would need to be replaced.

- Outstanding debts, such as your mortgage, car loans, or student loans.

- Future expenses, including education costs for children or retirement needs.

- Final expenses, including funeral and burial costs.

2. Decide on the Type of Coverage

Determine whether you need temporary coverage (term life insurance) or permanent coverage (whole life, universal life, or variable life insurance). If you need coverage for a set period, such as while raising children, term life insurance may be sufficient. If you want lifelong protection and the ability to build cash value, permanent life insurance might be the right choice.

3. Compare Premiums

Get quotes from multiple insurers and compare their premiums, coverage options, and benefits. Keep in mind that permanent life insurance policies tend to be more expensive than term policies. However, the long-term benefits of permanent insurance may outweigh the higher premiums if you are looking for lifetime coverage and cash value growth.

4. Consider Your Health

Your health is one of the most important factors in determining your premiums. Insurers typically require a medical exam before issuing a policy. If you are in good health, you may qualify for lower premiums. If you have health issues, you may still be able to get coverage, but at a higher cost.

5. Check the Insurer’s Reputation

Research insurance companies and check their financial strength, customer service, and claims history. You want an insurer that is financially stable and reliable, ensuring that they will be able to pay out your death benefit when the time comes.

Factors That Affect Life Insurance Premiums

Several factors influence how much you will pay for life insurance:

- Age: The younger you are when you buy life insurance, the lower your premiums will be.

- Health: Good health generally leads to lower premiums. If you smoke or have health issues, your premiums will be higher.

- Gender: Women typically pay lower premiums than men due to their longer life expectancy.

- Policy Type: Permanent policies (whole life, universal life, variable life) tend to be more expensive than term life policies.

- Coverage Amount: The higher your death benefit, the higher your premiums will be.

- Occupation and Lifestyle: High-risk jobs or hobbies (such as skydiving or scuba diving) may lead to higher premiums.

Conclusion

Life insurance is an essential component of any well-rounded financial plan. It provides the security and peace of mind that your loved ones will be taken care of financially, even in your absence. With a variety of policies available, there is a life insurance plan suited for everyone’s needs. Whether you choose term life insurance for short-term coverage or permanent life insurance for long-term benefits, it’s important to understand the different options and choose the best one for your unique situation.

Post Views: 5

Genre: Blog

Director:

You may also like

Report Content

A Comprehensive Guide to Life Insurance Protecting Your Future

Movie