What Is Auto Insurance?

Auto insurance is a contract between you and an insurance provider that offers financial protection against losses arising from accidents, theft, or damage to your vehicle. In exchange for a premium, the insurer agrees to cover specific risks outlined in your policy.

Why Is Auto Insurance Necessary?

- Legal Requirement: In most states and countries, having at least a minimum level of auto insurance is mandatory.

- Financial Protection: Accidents can lead to significant expenses, including vehicle repairs, medical bills, and legal fees.

- Peace of Mind: Knowing you’re protected from unforeseen circumstances allows you to drive confidently.

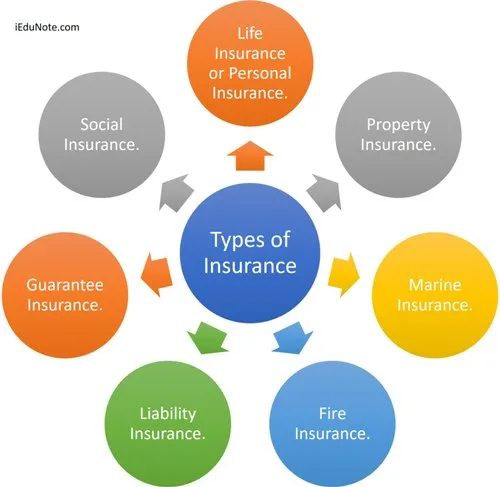

Types of Auto Insurance Coverage

Auto insurance policies offer various types of coverage to meet different needs. Here’s a breakdown of the main coverage types:

1. Liability Coverage

Liability coverage is typically required by law and covers:

- Bodily Injury: Medical expenses, lost wages, and legal fees for injuries caused to others in an accident you’re responsible for.

- Property Damage: Costs to repair or replace someone else’s property (e.g., their car or fence).

2. Collision Coverage

This covers repair or replacement costs for your vehicle if it’s damaged in a collision, regardless of who is at fault.

3. Comprehensive Coverage

Comprehensive coverage protects against non-collision-related damages, such as:

- Theft or vandalism

- Natural disasters like floods, hailstorms, or earthquakes

- Hitting an animal

- Falling objects

4. Uninsured/Underinsured Motorist Coverage

This provides financial protection if you’re involved in an accident caused by a driver with no insurance or insufficient coverage.

5. Medical Payments (MedPay) or Personal Injury Protection (PIP)

Covers medical expenses for you and your passengers, regardless of fault. PIP may also include lost wages and funeral costs.

6. Gap Insurance

If your vehicle is totaled, gap insurance covers the difference between the car’s depreciated value and the amount you owe on your loan or lease.

7. Roadside Assistance

An optional add-on that provides services like towing, battery jump-starts, and flat tire changes.

How Auto Insurance Works

Auto insurance works by pooling premiums from many customers to cover the costs of accidents and damages. Here’s a simplified explanation:

- Premium Payments: You pay a premium (monthly, quarterly, or annually) based on your policy.

- Deductibles: In case of a claim, you pay a deductible—a pre-agreed amount before the insurer covers the remaining costs.

- Coverage Limits: Policies have maximum limits for payouts. Costs exceeding these limits become your responsibility.

For example, if your liability policy covers up to $50,000 for bodily injury but the medical costs total $70,000, you would need to pay the $20,000 difference.

How to Choose the Right Auto Insurance Policy

Selecting the right policy involves balancing cost and coverage. Here are steps to guide you:

1. Assess Your Needs

- Driving Habits: Long commutes or frequent road trips may require higher coverage.

- Vehicle Value: Older cars might not need comprehensive or collision coverage.

- Financial Stability: Consider how much out-of-pocket expense you can afford for deductibles.

2. Understand Legal Requirements

Different states or countries have varying minimum insurance requirements. Ensure your policy meets these to avoid legal penalties.

3. Compare Multiple Quotes

Use online comparison tools to evaluate policies from different insurers. Don’t just focus on price; consider coverage options, customer service, and claim settlement processes.

4. Look for Discounts

Many insurers offer discounts, including:

- Safe driver discounts

- Bundling auto and home insurance

- Good student discounts

- Low mileage discounts

- Vehicle safety features (e.g., anti-theft systems)

5. Review the Insurer’s Reputation

Check customer reviews, complaint records, and financial stability ratings to ensure you’re choosing a reliable company.

Factors That Affect Auto Insurance Premiums

Several factors influence how much you’ll pay for auto insurance:

1. Age and Gender

Young, inexperienced drivers and male drivers typically face higher premiums due to a higher likelihood of accidents.

2. Driving History

A clean driving record can significantly reduce premiums, while accidents or traffic violations can increase them.

3. Location

Urban areas with high traffic density and crime rates often have higher insurance costs than rural locations.

4. Vehicle Type

Luxury or sports cars are more expensive to insure due to higher repair costs and theft risks.

5. Credit Score

In many states, insurers consider credit scores to determine risk. A higher credit score often results in lower premiums.

6. Coverage Levels

Comprehensive policies with low deductibles cost more than basic liability coverage.

How to Save Money on Auto Insurance

Here are practical ways to lower your insurance costs without compromising coverage:

1. Bundle Policies

Combine your auto insurance with home, renters, or life insurance for multi-policy discounts.

2. Increase Your Deductible

Opting for a higher deductible reduces your premium, but ensure you can afford the out-of-pocket cost in case of a claim.

3. Maintain a Clean Driving Record

Safe driving habits can qualify you for significant discounts.

4. Shop Around Annually

Compare rates from different insurers each year to find the best deal.

5. Take Advantage of Discounts

Ask your insurer about additional discounts for things like being a student, veteran, or member of certain organizations.

6. Drive Less

Lower mileage can qualify you for reduced rates under usage-based or pay-as-you-go insurance programs.

What to Do After an Accident

Knowing how to handle an accident ensures a smoother claims process:

1. Ensure Safety

Move to a safe location and check for injuries. Call emergency services if needed.

2. Exchange Information

Gather the other driver’s contact details, insurance information, and vehicle registration.

3. Document the Scene

Take photos of the accident, damage, and road conditions. This evidence can be critical for claims.

4. File a Police Report

A police report is often required for insurance claims and can help determine fault.

5. Notify Your Insurer

Report the accident to your insurer promptly and provide all necessary details.

Common Auto Insurance Myths Debunked

- Red Cars Cost More to Insure

Your car’s color has no impact on insurance premiums. Factors like make, model, and engine size are more relevant. - Minimum Coverage Is Enough

While minimum liability coverage meets legal requirements, it may not fully protect you financially after a major accident. - Comprehensive Coverage Covers Everything

Despite its name, comprehensive coverage only protects against non-collision-related incidents like theft or natural disasters. - Older Drivers Always Pay Less

While experience can lower rates, older drivers may face higher premiums due to health-related risks.

How to File an Auto Insurance Claim

Filing a claim can feel daunting, but following these steps can simplify the process:

- Contact Your Insurer: Provide details about the accident and damages.

- Submit Documentation: Include photos, police reports, and repair estimates.

- Work With the Adjuster: They will assess the claim and determine compensation.

- Receive Payment: Once approved, you’ll receive reimbursement or direct payment to repair shops.

Why Regularly Review Your Policy Matters

Life changes like moving, buying a new car, or getting married can affect your insurance needs. Review your policy annually to ensure it still meets your requirements and offers the best value.

Conclusion

Auto insurance is a critical component of financial protection for any driver. By understanding coverage options, shopping wisely, and maintaining good driving habits, you can secure a policy that fits your needs and budget. Regularly reviewing your insurance and staying informed about industry trends can further enhance your protection and savings.

Invest the time to choose the right auto insurance policy today and enjoy the peace of mind that comes with knowing you’re prepared for whatever the road brings.