Understanding General Insurance: Protecting Your Future with the Right Coverage

In today’s uncertain world, insurance plays a crucial role in securing our financial future. While life and health insurance often take the spotlight, general insurance is equally important for protecting various aspects of our personal and professional lives. It covers a wide range of insurance policies that go beyond life and health, safeguarding your property, vehicles, businesses, and more.

This comprehensive article will delve into general insurance, explaining what it is, the different types of general insurance policies available, and why they are essential for every individual and business. Whether you’re a first-time buyer or someone looking to expand your knowledge, this guide will offer valuable insights into making informed decisions about your insurance needs.

What is General Insurance?

General insurance, also known as non-life insurance, refers to any insurance policy that does not fall under life insurance. It covers a broad spectrum of risks, from property and vehicle damage to business liabilities. Unlike life insurance, which provides coverage for a specified term of life, general insurance policies provide protection against a wide range of risks over a short term, usually one year.

While life insurance provides financial support in case of death, general insurance offers a safety net for tangible assets, covering unexpected incidents such as accidents, theft, fire, or natural disasters.

Key Features of General Insurance:

- Short-term Coverage: Most general insurance policies are valid for one year and are renewed annually.

- Non-Life Protection: It covers property, vehicles, businesses, and liabilities, unlike life insurance, which is designed to cover life and health risks.

- Financial Protection: In the event of an accident, loss, or damage, general insurance ensures that policyholders don’t bear the full financial burden.

By purchasing general insurance, individuals and businesses can safeguard themselves from unforeseen financial losses, making it a crucial part of financial planning.

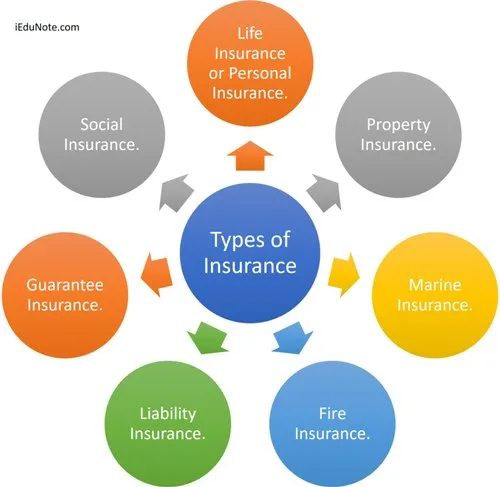

Types of General Insurance

General insurance encompasses a wide range of policies, each designed to cover specific risks. Let’s explore some of the most common types of general insurance that individuals and businesses often consider:

1. Motor Insurance

Motor insurance is one of the most popular forms of general insurance. It provides coverage against damage, loss, or theft of vehicles such as cars, bikes, and trucks. Motor insurance is mandatory in many countries, ensuring that drivers are financially protected in case of accidents or damages.

Types of Motor Insurance:

- Third-Party Insurance: This is the most basic form of motor insurance. It covers damage or injury caused to other people or property in an accident. However, it does not cover damages to the policyholder’s own vehicle.

- Comprehensive Insurance: This type of insurance covers both third-party liabilities and damages to the policyholder’s own vehicle. It provides protection against accidents, theft, fire, and natural disasters.

- Own Damage Insurance: This covers damage to your own vehicle caused by an accident or other covered incidents but does not include third-party liabilities.

Motor insurance not only protects you against financial losses in the event of an accident but also helps with repair costs, medical expenses, and legal liabilities.

2. Home Insurance

Home insurance provides coverage for your home and its contents against risks such as fire, theft, vandalism, and natural disasters like floods or earthquakes. Home insurance can be tailored to meet specific needs, including coverage for buildings, contents, and personal belongings.

Types of Home Insurance:

- Building Insurance: Covers the structure of the property, including walls, roof, and foundations, against damage caused by events such as fire, storms, or earthquakes.

- Contents Insurance: Covers the belongings inside the home, such as furniture, electronics, and clothing, against theft, fire, or accidental damage.

- Comprehensive Home Insurance: This includes both building and contents insurance, offering full protection for the home and its possessions.

Home insurance provides peace of mind by ensuring that your property and belongings are protected, allowing you to recover from potential losses.

3. Health Insurance

Health insurance is a vital aspect of general insurance that covers medical expenses for illnesses, injuries, and surgeries. With rising healthcare costs, health insurance has become essential for individuals and families to ensure they are financially protected when medical emergencies arise.

Types of Health Insurance:

- Individual Health Insurance: Provides coverage for the policyholder against medical expenses incurred due to illness or injury.

- Family Floater Plans: Covers the entire family under a single policy, ensuring that all members are protected against healthcare expenses.

- Critical Illness Insurance: Offers a lump sum payout in case the policyholder is diagnosed with a serious illness such as cancer, heart attack, or stroke.

- Hospital Cash Insurance: Provides a fixed daily amount in case the policyholder is hospitalized.

Health insurance helps cover medical bills, hospital stays, surgeries, and treatments, preventing you from facing financial difficulties during medical emergencies.

4. Travel Insurance

Travel insurance offers coverage for individuals traveling abroad or domestically. It helps protect against unforeseen events such as trip cancellations, lost luggage, medical emergencies, or accidents while traveling.

Types of Travel Insurance:

- Trip Cancellation Insurance: Provides coverage if you need to cancel your trip due to unforeseen circumstances such as illness, job loss, or natural disasters.

- Medical Travel Insurance: Covers medical expenses incurred while traveling abroad, including emergency medical treatment and hospitalization.

- Lost Baggage Insurance: Provides compensation for lost or delayed luggage during your trip.

Travel insurance ensures that you are protected against unexpected incidents, allowing you to travel with peace of mind.

5. Business Insurance

Business insurance provides coverage for businesses against risks such as property damage, employee injuries, theft, and legal liabilities. It is essential for entrepreneurs and businesses to protect their assets and ensure smooth operations in case of unforeseen disruptions.

Types of Business Insurance:

- Property Insurance: Covers physical assets such as buildings, machinery, and equipment against damage or loss due to fire, theft, or natural disasters.

- Liability Insurance: Protects businesses against legal claims and lawsuits arising from accidents or injuries to employees or customers.

- Workers’ Compensation Insurance: Provides compensation for employees who are injured on the job, covering medical expenses and lost wages.

- Business Interruption Insurance: Covers losses due to unexpected interruptions in business operations, such as natural disasters or accidents.

Business insurance is vital for protecting a company’s assets and ensuring financial stability in the event of a crisis.

6. Fire Insurance

Fire insurance is a specialized form of property insurance that covers the costs of damage or loss caused by fire. It includes coverage for buildings, equipment, and other assets that may be affected by a fire. This type of insurance is especially important for businesses and homeowners located in areas prone to fires.

Coverage Offered:

- Property Damage: Covers the repair or replacement of damaged property caused by fire.

- Loss of Income: For businesses, fire insurance may also cover the loss of income due to a business interruption caused by fire damage.

- Additional Expenses: This may include the cost of temporary accommodation or business relocation while repairs are being made.

Fire insurance is crucial for both homeowners and business owners to ensure that they are financially protected in case of a fire.

Why is General Insurance Important?

General insurance plays a pivotal role in providing financial protection against unexpected events. It acts as a safety net, ensuring that you are not financially crippled by unforeseen circumstances. Here are some of the key reasons why general insurance is essential:

1. Financial Protection

Life is unpredictable, and accidents, illnesses, or natural disasters can happen at any time. General insurance provides financial protection by covering the costs associated with these events. Whether it’s a car accident, a house fire, or medical expenses, insurance helps mitigate the financial burden, ensuring you don’t have to bear the full cost of repairs, hospital bills, or damages.

2. Peace of Mind

Knowing that you have insurance coverage for your property, health, vehicle, and business gives you peace of mind. With insurance in place, you can focus on other important aspects of life without worrying about the potential financial impact of unexpected incidents.

3. Legal Requirement

In many cases, certain types of general insurance, such as motor insurance and workers’ compensation, are legally required. Failing to comply with these laws can result in penalties, fines, or even legal consequences.

4. Risk Management

Insurance helps manage and mitigate risks associated with daily life. By transferring the financial risk to an insurance provider, you are better equipped to handle emergencies without depleting your savings or investments.

5. Protection for Your Loved Ones

In the event of an accident or unforeseen circumstance, having the right general insurance policies in place ensures that your loved ones are not left with financial hardship. Whether it’s through health insurance or home insurance, general insurance helps provide financial security for your family.

How to Choose the Right General Insurance Policy

Choosing the right general insurance policy can be a daunting task, especially with the variety of options available. Here are some steps to help you make an informed decision:

1. Assess Your Needs

Consider what you need to insure. Are you looking to protect your car, home, health, or business? Identify the risks you face and choose insurance policies that provide comprehensive coverage.

2. Compare Policies

Different insurance providers offer different coverage options, terms, and premiums. Compare various policies, considering factors such as coverage limits, exclusions, and premiums, to find the policy that best suits your needs and budget.

3. Read the Fine Print

Ensure that you read and understand the terms and conditions of the insurance policy. Pay attention to exclusions, deductibles, and coverage limits to avoid surprises when filing a claim.

4. Check for Discounts

Many insurance companies offer discounts or bundled packages. If you purchase multiple policies, such as car and home insurance, you may be eligible for discounts. Take advantage of these offers to save on premiums.

5. Choose a Reliable Insurer

It’s important to choose an insurance provider with a good reputation for customer service and claims processing. Check reviews, ask for recommendations, and ensure the company has a solid track record of handling claims promptly.

Conclusion

General insurance is an essential part of securing your financial future. It provides protection for your property, health, vehicles, businesses, and more, giving you peace of mind in an unpredictable world. By understanding the different types of general insurance available and choosing the right policies for your needs, you can ensure that you are well-prepared for life’s uncertainties.

Investing in general insurance is not just a financial decision—it’s a smart way to protect your loved ones, assets, and peace of mind. Whether you’re insuring your car, home, health, or business, general insurance is an investment in a safer, more secure future.