Toggle light

Comments

58 Views

Report

Favorite

If current server doesn't work please try other servers below.

Server

2embed

Server

Multi

Server

Vidsrc

Score: 10 / 5 rated

Understanding Marine Insurance Safeguarding Goods and Cargo on the High Seas

Understanding Marine Insurance: Safeguarding Goods and Cargo on the High Seas

In the world of global trade and commerce, goods and merchandise are transported across vast oceans every day. Whether by ship, cargo vessel, or container, the transportation of goods by sea plays a central role in the global economy. However, shipping goods across the seas comes with various risks. From unpredictable weather conditions to piracy and accidents, there are numerous hazards that can cause damage, loss, or delay to the cargo. This is where marine insurance comes in.

Marine insurance is a specialized form of insurance designed to protect the interests of those involved in shipping and maritime activities. It provides financial protection against risks related to the transport of goods and vessels on the sea. This article explores what marine insurance is, the types of coverage available, why it’s important, and how to choose the right marine insurance policy for your needs.

What is Marine Insurance?

Marine insurance is a type of insurance designed to provide financial protection against risks associated with the transportation of goods over water. This coverage is essential for businesses, shipping companies, and individuals involved in maritime trade. The policy can cover the cargo being shipped, the vessel transporting it, and the liability incurred due to accidents or damages that may occur during transit.

Marine insurance is vital because sea transport is inherently risky. In addition to the physical perils of the sea, vessels and goods are exposed to other risks such as piracy, theft, and natural disasters. With marine insurance, individuals and businesses can mitigate financial loss and ensure that they are protected in the event of an incident.

Key Features of Marine Insurance:

- Risk Coverage: Marine insurance covers risks related to goods, vessels, and third-party liabilities during the transportation process.

- Global Protection: Given the international nature of shipping, marine insurance provides protection worldwide, ensuring that goods in transit across the globe are covered.

- Variety of Policies: There are several types of marine insurance policies, offering different levels of protection depending on the nature of the cargo and the specific risks involved.

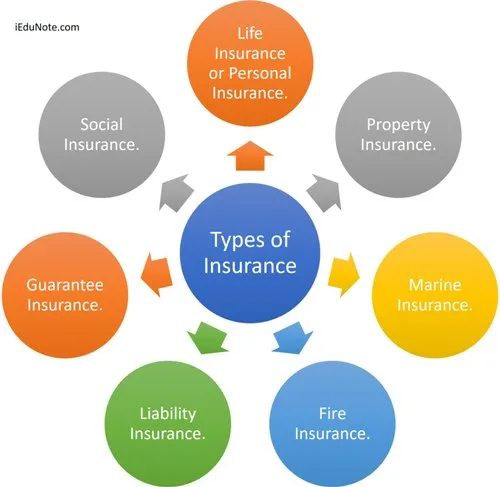

Types of Marine Insurance

Marine insurance is not a one-size-fits-all product. There are various types of marine insurance policies, each tailored to address different needs. The three main types of marine insurance are:

1. Hull Insurance

Hull insurance, as the name suggests, covers the vessel itself. It protects the ship or boat from damage caused by accidents, natural disasters, or other mishaps that might occur during the course of its operation. The policy provides coverage for the physical damage to the vessel’s structure, machinery, and equipment.

Types of Hull Insurance:

- Total Loss Hull Insurance: This covers the total loss of the vessel due to accidents or disasters, such as sinking, fire, or collision.

- Partial Loss Hull Insurance: This covers damages that are not severe enough to be considered a total loss but still result in expensive repairs.

- Collision Liability: Hull insurance may also cover liability for damages caused to other vessels or property in case of a collision.

Hull insurance is crucial for shipping companies and owners of private vessels to safeguard the value of their ships and avoid financial hardship due to repair costs or loss.

2. Cargo Insurance

Cargo insurance is designed to protect the goods being transported across the sea. It covers the risk of damage or loss to the cargo due to various factors, such as accidents, natural disasters, or theft. Cargo insurance is essential for businesses involved in shipping goods internationally or domestically, as it ensures that the goods arrive at their destination safely.

Types of Cargo Insurance:

- All-Risk Insurance: This is the most comprehensive form of cargo insurance. It covers all potential risks unless specifically excluded in the policy. It offers protection against a wide range of incidents, such as fire, accidents, theft, and damage during transit.

- Named Perils Insurance: This type of cargo insurance covers only the risks specifically mentioned in the policy, such as theft, fire, or sinking. If the cargo is damaged or lost due to any other cause, the insurer will not pay.

- Open Policy: Often used by businesses that regularly ship goods, an open policy covers all shipments over a specified period. This type of insurance provides ongoing coverage and can be more cost-effective for frequent shippers.

Cargo insurance provides the peace of mind that comes with knowing that goods will be compensated for if they are damaged, stolen, or lost during transit.

3. Liability Insurance

Liability insurance in marine contexts refers to the protection provided to shipowners and operators for legal liabilities they might face due to accidents or damages involving their vessel. This type of insurance covers third-party claims that may arise due to the operation of a vessel.

Types of Liability Insurance:

- Protection and Indemnity (P&I) Insurance: P&I insurance covers a shipowner’s legal liabilities for injuries to passengers and crew members, as well as damage to property or the environment. It also covers claims related to pollution, collisions, and damage to goods or cargo.

- Freight Insurance: This covers the shipowner’s liability for the freight value in the event of non-delivery or damage to goods during transit.

Liability insurance is important for shipowners, operators, and cargo owners, as it helps cover the financial risks associated with accidents and damages caused by their vessels.

4. Marine Trade Insurance

Marine trade insurance is typically aimed at businesses involved in the broader maritime industry, such as shipyards, boat dealers, and suppliers of marine equipment. It covers a wide range of risks faced by these businesses, including damage to premises, equipment, and goods in transit.

Coverage May Include:

- Property Damage: Covers physical damage to the business’s property, including machinery and equipment.

- Business Interruption: Provides coverage if the business is forced to shut down temporarily due to damage or loss.

- Liability: Covers third-party claims for damage or injuries caused by the business’s activities.

This insurance is essential for businesses involved in the marine sector, as it provides protection against the various risks that arise in the course of business operations.

Why is Marine Insurance Important?

Marine insurance is critical for protecting goods, vessels, and businesses from the myriad risks they face while at sea. Whether you’re a shipping company, a cargo owner, or a vessel operator, marine insurance provides essential coverage that can safeguard your financial interests. Here’s why marine insurance is so important:

1. Protection Against Unpredictable Risks

The sea is inherently unpredictable, and there are many risks associated with maritime transport. From storms and high winds to piracy and human error, there are countless dangers that can lead to loss or damage to vessels or cargo. Marine insurance protects against these uncertainties, ensuring that the financial burden is not solely placed on the shipowner or cargo owner.

2. Legal Requirements

In many countries, marine insurance is a legal requirement for businesses involved in shipping goods or operating vessels. Whether it’s hull insurance, cargo insurance, or liability insurance, having the right coverage ensures compliance with maritime regulations and laws.

3. Financial Security

Without marine insurance, a single mishap could result in significant financial losses. Shipowners, cargo owners, and businesses could be left with massive repair costs, compensation claims, or loss of revenue. Marine insurance offers a safety net, ensuring that businesses remain financially secure even after an unfortunate incident.

4. Peace of Mind

Knowing that your cargo, vessel, or business is protected against risks allows you to focus on the operations at hand without constant worry. Whether you’re transporting high-value goods or operating a vessel across the globe, marine insurance offers peace of mind, knowing you’re financially covered in case of unforeseen circumstances.

5. Global Trade Support

In an increasingly interconnected world, international trade relies heavily on maritime transport. Marine insurance supports global trade by providing protection to shipments and vessels crossing international borders. With insurance in place, businesses can engage in cross-border trade with confidence, knowing that their goods are covered against potential risks.

How to Choose the Right Marine Insurance Policy

Choosing the right marine insurance policy depends on several factors, including the nature of your cargo, the type of vessel, and the risks you’re exposed to. Here are some important considerations when selecting a marine insurance policy:

1. Evaluate the Risks

Before purchasing marine insurance, assess the risks your cargo or vessel may face during transit. Are you shipping fragile goods that could be damaged easily? Does your vessel operate in high-risk areas prone to piracy or severe weather? Understanding your specific risks will help you choose the right coverage.

2. Understand the Coverage Options

Different types of marine insurance offer varying levels of coverage. Make sure you understand what is included in the policy and any exclusions or limitations. For example, some policies may not cover certain types of damage, such as wear and tear or poor handling of goods.

3. Check the Insurer’s Reputation

Choose an insurance provider with a good reputation for reliability, customer service, and claims handling. You want an insurer that can handle claims efficiently and fairly, especially in the event of a major loss.

4. Compare Premiums and Deductibles

Marine insurance premiums can vary depending on the coverage and the level of protection. Compare quotes from different insurers to ensure you get the best deal. Additionally, check the deductible amounts to understand how much you’ll need to pay out of pocket in case of a claim.

5. Consult a Marine Insurance Broker

If you’re unsure about the best policy for your needs, consult a marine insurance broker. These professionals can help assess your risks and recommend the most appropriate coverage for your specific situation.

Conclusion

Marine insurance is a vital tool for anyone involved in shipping goods, operating vessels, or managing a business in the maritime industry. It provides protection against the risks of the sea, safeguarding both the assets and the financial interests of those who rely on global trade and maritime transportation. Whether it’s hull insurance, cargo insurance, liability coverage, or marine trade insurance, the right policy ensures that you’re protected from unexpected events.

In the unpredictable world of maritime transport, investing in marine insurance isn’t just a precaution—it’s a necessity. With the right coverage, businesses and individuals can navigate the risks of the sea with confidence, ensuring the safety and security of their goods and vessels while fostering the growth of international trade.

Post Views: 4

Genre: Blog

Director:

You may also like

Report Content

Understanding Marine Insurance Safeguarding Goods and Cargo on the High Seas

Movie